Raiffeisen Bank

Jul 2020 – Oct 2022

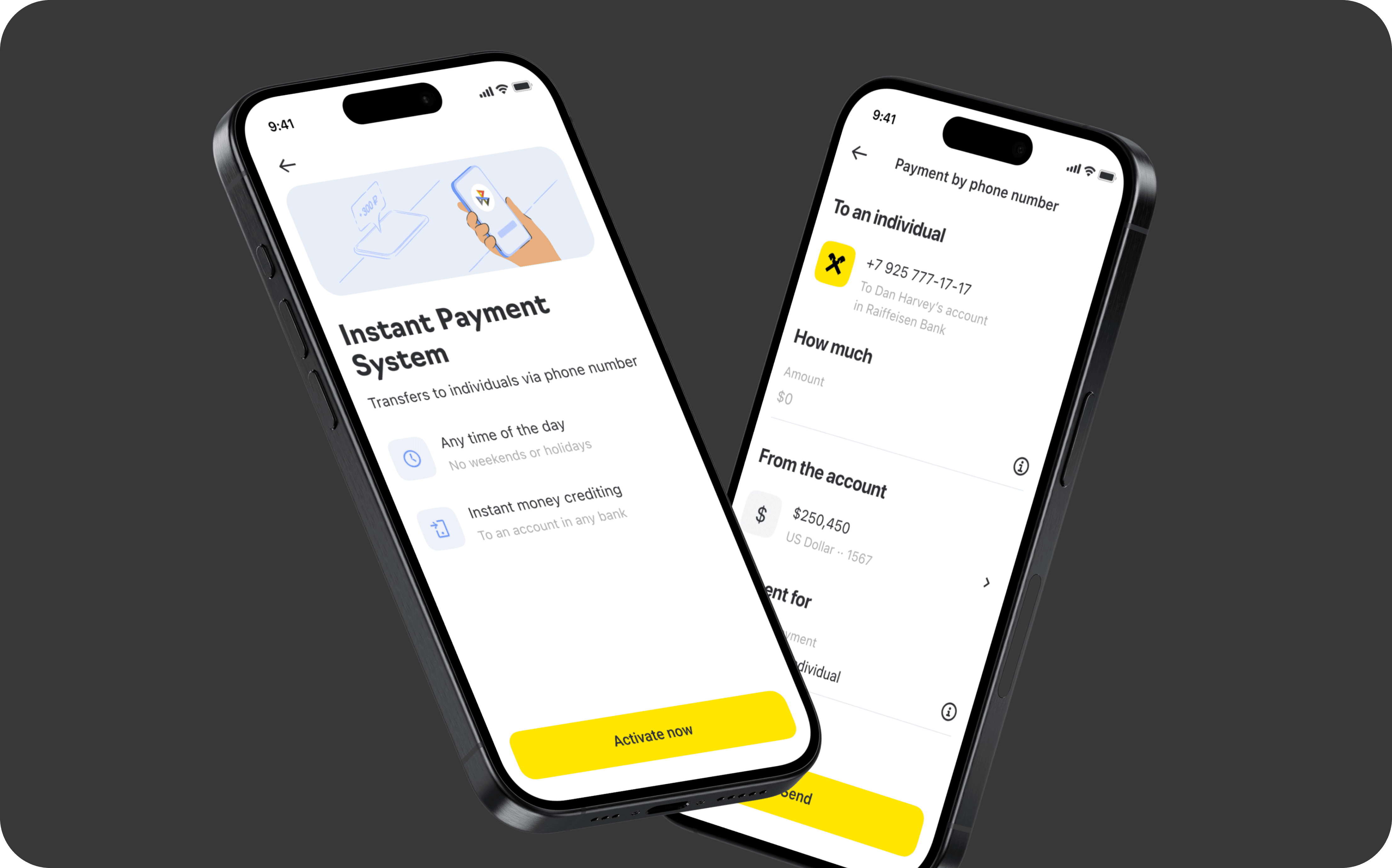

My team and I developed a new payment flow for individual owners of unincorporated businesses, enabling them to pay for services

to other owners or instantly withdraw funds from their business accounts to over 200+ banks.

As a result conversion rate to successful payment was 62%.

Customer portrait

Owners of private limited companies are legally authorized to conduct business activities and can generate income of up to $2,650,000.

Challenges

One of the primary objectives of our team was to transition customers who exclusively used the web version to the app by incorporating this functionality into the application.

When I began working on this feature, individual entrepreneurs could only send money to other individuals using account details, with banks taking up to 3 business days to process these payments, which was too lengthy compared to transfers that could be processed instantly.

In Russia, the rapidly growing 'Fast Payment System' has become very popular among individuals, prompting our decision to implement this technology.

What is ‘Fast payment system’

The Fast Payments System (FPS) in Russia facilitates interbank transfers via mobile phone number round the clock, involving over 200+ banks, including major ones, and without commissions. FPS also supports payments via QR code and receipt of payments from organizations.

The chart illustrates the rapid growth of this payment system since 2019.

Hypothesis

Our main goal was to increase share payments metric for the mobile app to the end of the year. So our hypothesis was:

'Fast Payment System' will boost the app's payment share metric

Solutions

Activation in a single click

During the initial interaction, all necessary and optional fields are presented. We chose to fetch this information from our backend and automatically populate all fields. The original flow persists for users whose information is not found in our database for some reason.

Recipients from the contact list

To streamline the payment flow, I integrated the phone contact list and placed the owner's phone number at the top, as it's the most common scenario. Additionally, users still have the option to send money to a number not listed in their contacts.

Arrangement of the bank list based on popularity

There are more than 200 banks listed, so I've placed the top 5 banks at the forefront, with Raiffeisen Bank taking top priority.

Entry points across various sections

of the mobile app to encourage feature activation

We've strategically placed entry points throughout different sections of the mobile app to encourage users to activate the feature.

Hint for amount limits

Different limits apply for transfers within the same bank and to other banks. To clarify this for users, I included the remaining amount

in a tip and created a detailed hint with a progress bar.

Result

It was premature to calculate the payment share metric.

However, the conversion rate to successful payment was:

62%